Welcome

- Home

- Why Churchills

- Meet The Team

- Industry News

- Guild Members

- Churchills Club

- Churchills Club Winner

- Testimonials

- York Property News

- Helpful Guides

Posted on: Friday, March 17, 2023

Despite the brake on house-price growth, the market, as well as economic outlook, is showing tentative green shoots as we head towards spring.

There has been a welcome fall in mortgage rates, with rates of below 4% for lower loan-to-value mortgages. Typical costs of a two-year deal and five-year fixed-rate mortgage have fallen back to where they were in October 2022, in spite of the Bank of England Bank Rate rising by 1.75% during this period. There has also been a rise in the number of mortgage products, with over 4,000 different products now available. The number of days a product is available before it is withdrawn has also increased, now at 28 days, up from just 15 days in January, the highest level since March 2022 (Zoopla).

The housing market and economy are closely interlinked, and despite the rising cost of living, the rate of inflation has slowed and is expected to fall back over the course of the year. Employment levels remain strong, GDP forecasts are improving and any recession is expected to be less severe than first predicted. Prices are softening but many sellers continue to be over-optimistic on price. With supply returning to more normal levels, up 60% compared to a year ago, there is more choice for prospective purchasers and Zoopla report the average discount to asking price is currently 4.5%.

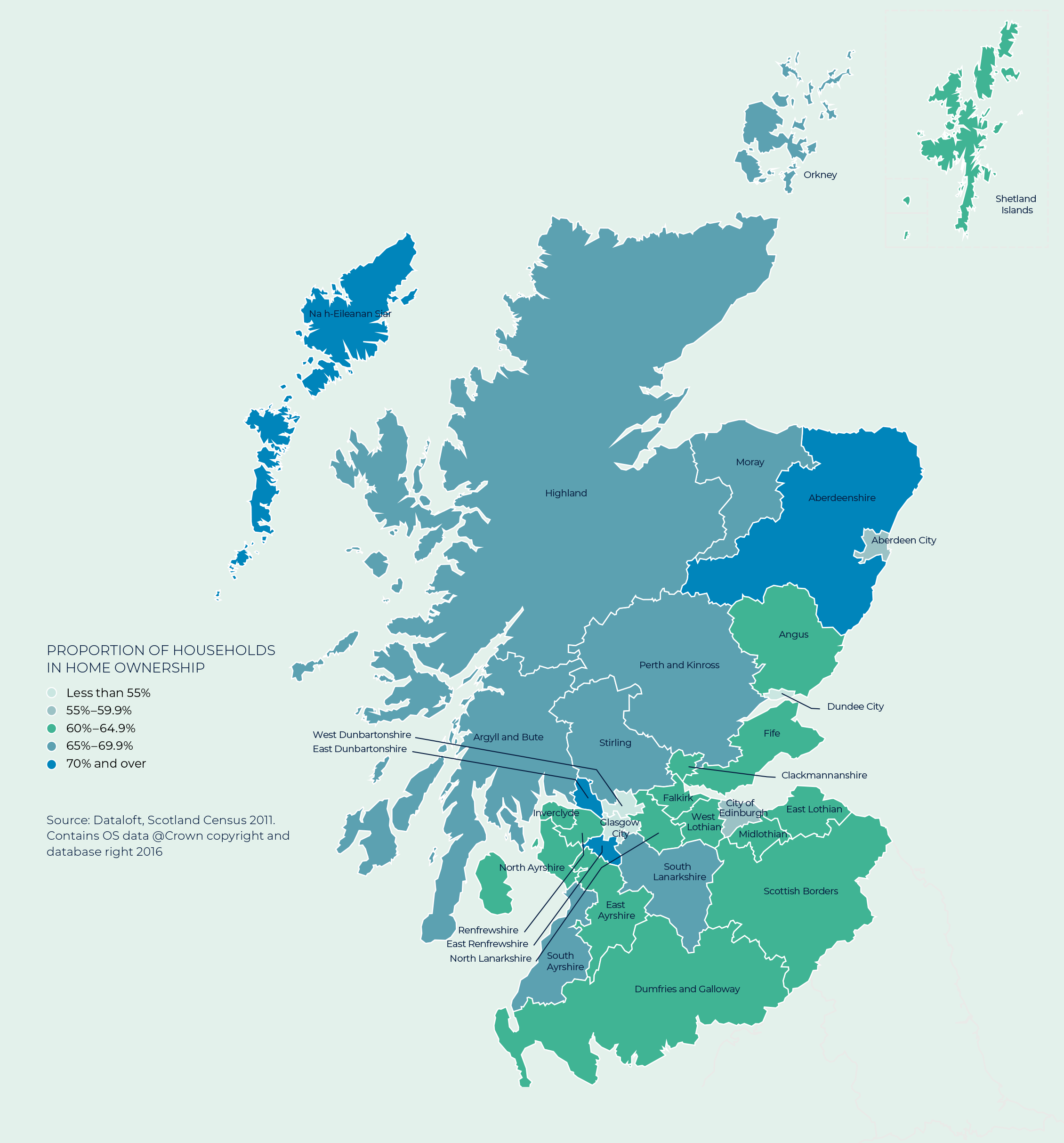

Scotland is still awaiting the publication of the results from the 2022 census, but data from the 2011 census indicates that home ownership is likely to remain the prevalent housing tenure across the country. In 2011, 62% of all households were in home ownership, of which 45% were owned outright and the remaining 55% with a mortgage.

The proportion of home-owning households varies from over 80% in East Renfrewshire and East Dunbartonshire to less than 60% in many of the major cities. The proportion of homeowners who own their home outright is highest in Na h-Eileanan and the Orkney Islands and lowest in West Lothian and North Lanarkshire.

The pendulum is swinging back in favour of the buyer as 2023 unfurls. Although the number of properties available to sell remains lower than the last so-called normal market of 2019, the supply of new stock to the market is higher than a year ago, offering buyers more choice. The time taken to sell a property is edging upwards and sellers need to be sensible when pricing their property to reflect market conditions. Across 2023, sales volumes are expected to pare back to pre-pandemic levels of around 1 million.

Houses remain the most sought-after property choice for new buyers across the market, but the proportion of prospective purchasers seeking an apartment has risen. Although 39% of new buyers are looking for a three-bed house, the most in-demand property type, Hometrack report that more than three in ten buyers are now looking to purchase an apartment. Apartments are a particularly sought-after option for first-time buyers.

Sell your property with your local expert this winter. Contact your local Guild Member today.